In order to honour the efforts of Defence Personnel, the government offers special income tax benefits, allowance, and exemptions.

Reetu | May 2, 2025 |

Income Tax Guide for Indian Defence Personnel for Tax Filing, Taxable Allowances and Other Benefits

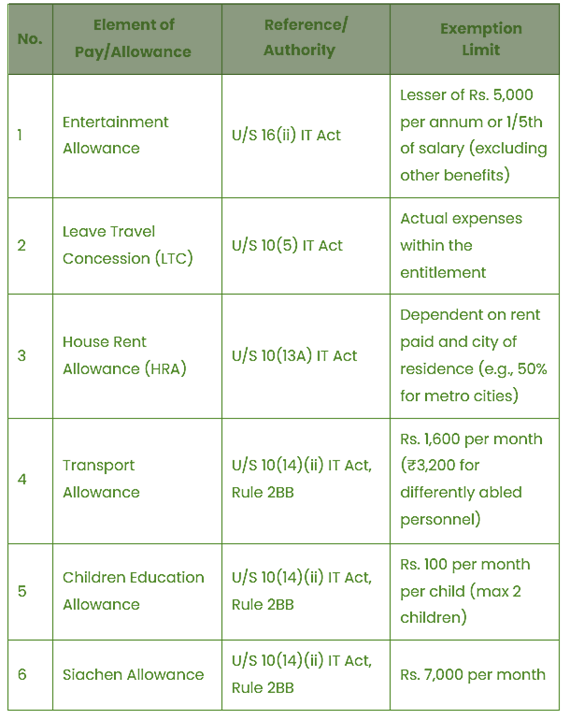

The brave men and women of the Indian Armed Forces and security professionals bear an immense responsibility of protecting our country. In order to honour their efforts, the government offers special income tax benefits, allowances, and exemptions.

This income tax guide attempts to simplify the tax filing process for Indian defence personnel by outlining taxable and tax-free allowances, deductions, and methods for maximising refunds while remaining within the boundaries of law.

For filing your ITR correctly, collect these essential documents:

Form 16: The following document summarises your salary and the tax deductions made by your employer. It is available for download through your employer’s portal.

Salary Slip: Form 16 under the New Tax Regime may not represent exempt allowances, so it is essential to identify them.

Form 26AS and AIS: These reports include your tax deducted at source (TDS), income information, and any transactions that may affect your return.

Once you have these documents, log in to the Income Tax Portal, create a new filing, and select ITR-1 (for salaried individuals). Individuals who do share/mutual fund transactions must file ITR-2.

Old Tax Regime

1. Higher tax rates, but with deductions and exemptions.

2. Defence personnel frequently benefit more from the Old Regime because of the variety of allowances and deductions available.

New Tax Regime

1. Lower tax rates, but no exemptions or deductions (such as HRA and 80C).

2. Default choice in Form 16 beginning with the financial year 2024-25.

Note: When filling your ITR, you can choose to opt out of the New Regime under Section 115BAC if the Old Regime better suits your financial circumstances.

When your TDS exceeds your tax liability, you are eligible for a refund. Here’s how you can verify accuracy:

The tax system for defence personnel provides significant rewards to recognize their service contribution. Understanding which allowances are exempt, partially taxable, or totally taxable will help you lower your taxable liability and maximize your refund. Select the most suitable tax regime, verify your TDS, and claim all available deductions. Most people save more under the Old Tax Regime.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"